top of page

Weighted Average Cost of Capital (WACC) in Valuation

Understanding and accurately performing a wacc calculation is essential for businesses, investors, and finance professionals who want to assess investment opportunities and business value. The Weighted Average Cost of Capital (WACC) captures the blended cost of raising funds from both equity and debt, factoring in their proportions within a firm’s capital structure. In valuation, WACC is used as a discount rate to evaluate the desirability of projects, price mergers or acquis

3 min read

FCFF vs FCFE: Free Cash Flow Metrics Explained

Understanding the difference between FCFF and FCFE is crucial for finance professionals engaged in corporate valuation, investment banking preparation, or anyone seeking advanced insights into cash flow analysis. "FCFF vs FCFE" is one of the most searched queries for valuation experts who want to correctly apply cash flow metrics to assess the financial health and intrinsic value of businesses, whether in Mumbai, Delhi, Bangalore, or any global business hub. What Are Free Cas

3 min read

Enterprise Value (EV): Complete Calculation Guide

Enterprise Value (EV) is a cornerstone metric in modern corporate valuation and investment analysis, serving as a comprehensive indicator of a company's true market value. This complete calculation guide covers everything you need to know about enterprise value right from its formula and calculation steps, to why it matters for valuation in the Indian context and globally. Whether you're a finance professional in Mumbai or a business owner in Delhi, understanding how to calcu

4 min read

409A vs ISO vs NSO: Tax Implications

When navigating the complex world of employee equity compensation, understanding the distinctions between 409A vs ISO vs NSO is essential...

3 min read

Choosing a 409A Valuation Provider: Checklist

When it comes to issuing stock options, every startup must comply with IRS Section 409A requirements. Choosing the right 409A valuation...

3 min read

Penalties for Non-Compliant 409A Valuations

Section 409A of the Internal Revenue Code (IRC) plays a critical role in regulating nonqualified deferred compensation plans, including...

4 min read

Exit Valuation: Preparing for M&A or IPO

When a startup or growing company approaches an exit, understanding exit valuation is crucial. Exit valuation refers to the value of a...

3 min read

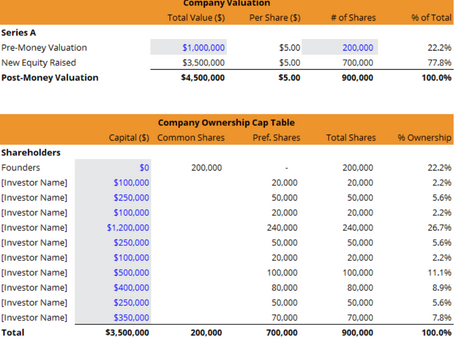

Using Cap Tables to Track Valuation Changes

In the fast-paced world of startups and investments, cap table valuation tracking is no longer just an administrative task it’s a...

4 min read

How to Value a Bootstrapped Startup

Valuing a bootstrapped startup is both an art and a science. Unlike their venture-funded counterparts, these startups are built on...

3 min read

Secondary Market Valuations: Liquidity Events

Understanding secondary market valuation is crucial for startups, investors, and employees navigating the complex world of private share...

2 min read

Valuing Startups in Fintech

In today’s dynamic investment environment, sector specific startup valuation is becoming essential, especially within transformative industries like Edtech & Clean Energy. While fintech startups have long been a focus for investors, emerging sectors such as edtech and clean energy are rapidly gaining attention for their growth potential and innovation, with valuation methods tailored to their unique characteristics. Understanding how to value startups across these sectors pro

4 min read

SAFE and Convertible Note Valuations

Early-stage startups often face the challenge of raising capital efficiently while minimizing legal complexities and maintaining focus on...

3 min read

Scorecard Method: Benchmarking Against Peers

The scorecard method valuation is a powerful tool widely used in the startup ecosystem to value early-stage companies by benchmarking...

4 min read

Venture Capital Method: Valuation for Series A & Beyond

Understanding the venture capital method valuation is crucial for founders and investors navigating the startup fundraising journey,...

3 min read

How to Prepare Your Financials for a Valuation

Valuation is one of the most critical steps for any business, whether you' re raising capital, selling your company, or planning for an...

3 min read

Company Valuation vs. Startup Valuation: Diverging Approaches

In today’s ever-changing business landscape, company valuation vs startup valuation has become a hot topic for entrepreneurs, investors,...

4 min read

Common Valuation Mistakes and How to Avoid Them

Valuations are critical in making informed decisions about investments, mergers, acquisitions, and financial reporting. However, common...

3 min read

How Valuation Firms Charge Fees: A Buyer's Guide

Understanding valuation firm fees is crucial for business owners, investors, and professionals seeking accurate and reliable business...

3 min read

Book Value vs. Market Value: Key Differences

Understanding the core valuation fundamentals of a company is essential for investors, finance professionals, and business enthusiasts...

4 min read

Discounted Cash Flow (DCF) Model Demystified

If you're looking to master the art of valuing businesses, the discounted cash flow model stands as one of the most powerful tools in...

3 min read

bottom of page