top of page

Weighted Average Cost of Capital (WACC) in Valuation

Understanding and accurately performing a wacc calculation is essential for businesses, investors, and finance professionals who want to assess investment opportunities and business value. The Weighted Average Cost of Capital (WACC) captures the blended cost of raising funds from both equity and debt, factoring in their proportions within a firm’s capital structure. In valuation, WACC is used as a discount rate to evaluate the desirability of projects, price mergers or acquis

3 min read

FCFF vs FCFE: Free Cash Flow Metrics Explained

Understanding the difference between FCFF and FCFE is crucial for finance professionals engaged in corporate valuation, investment banking preparation, or anyone seeking advanced insights into cash flow analysis. "FCFF vs FCFE" is one of the most searched queries for valuation experts who want to correctly apply cash flow metrics to assess the financial health and intrinsic value of businesses, whether in Mumbai, Delhi, Bangalore, or any global business hub. What Are Free Cas

3 min read

Enterprise Value (EV): Complete Calculation Guide

Enterprise Value (EV) is a cornerstone metric in modern corporate valuation and investment analysis, serving as a comprehensive indicator of a company's true market value. This complete calculation guide covers everything you need to know about enterprise value right from its formula and calculation steps, to why it matters for valuation in the Indian context and globally. Whether you're a finance professional in Mumbai or a business owner in Delhi, understanding how to calcu

4 min read

How Emerging Brands Like Nykaa and Lenskart Are Valued

EMERGING BRANDS VALUED In the rapidly evolving Indian market, understanding how emerging brands are valued like Nykaa and Lenskart...

3 min read

Unicorn Valuation: How Firms Cross the $1B Mark

In today’s dynamic startup ecosystem, achieving unicorn valuation signifies a prestigious milestone a private company reaching a...

3 min read

Paytm Valuation: Lessons from India's Fintech Giant

The paytm valuation has been a focal point of interest for investors, analysts, and fintech enthusiasts alike. As one of India's...

4 min read

SpaceX Valuation: Private vs Public Metrics

SpaceX valuation has captured headlines worldwide, offering a compelling case study in how private companies especially in the aerospace...

4 min read

OpenAI Valuation: How AI Drives Billion-Dollar Value

The openai valuation represents a captivating story of how artificial intelligence (AI) has transformed from an emerging technology into...

3 min read

Updating Your 409A Valuation After a Fundraise

Raising a new round of capital is an exciting milestone—it validates investor confidence, provides fresh momentum, and sets the stage for...

4 min read

How 409A Affects Employee Stock Options

Employee stock options (ESOPs) are a popular way for startups and growing companies to attract and retain talent by sharing equity with...

3 min read

409A vs ISO vs NSO: Tax Implications

When navigating the complex world of employee equity compensation, understanding the distinctions between 409A vs ISO vs NSO is essential...

3 min read

Penalties for Non-Compliant 409A Valuations

Section 409A of the Internal Revenue Code (IRC) plays a critical role in regulating nonqualified deferred compensation plans, including...

4 min read

Exit Valuation: Preparing for M&A or IPO

When a startup or growing company approaches an exit, understanding exit valuation is crucial. Exit valuation refers to the value of a...

3 min read

Role of Board-Approved Valuations in Fundraising

Raising capital is a critical phase for any startup, and one element that significantly boosts investor confidence is a board approved...

3 min read

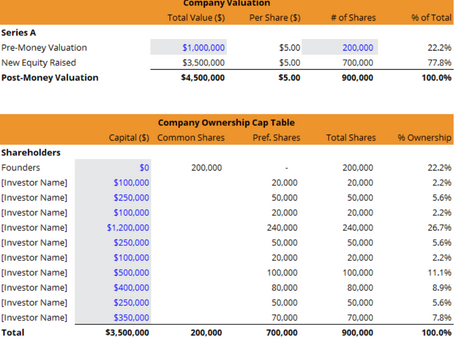

Using Cap Tables to Track Valuation Changes

In the fast-paced world of startups and investments, cap table valuation tracking is no longer just an administrative task it’s a...

4 min read

How to Value a Bootstrapped Startup

Valuing a bootstrapped startup is both an art and a science. Unlike their venture-funded counterparts, these startups are built on...

3 min read

Crowdfunding Valuation: What Backers Want to Know

Crowdfunding valuation has become a central aspect of fundraising campaigns for startups and entrepreneurs, especially across booming...

4 min read

Secondary Market Valuations: Liquidity Events

Understanding secondary market valuation is crucial for startups, investors, and employees navigating the complex world of private share...

2 min read

How Pandemic Shifts Changed Startup Valuations

The pandemic impact on startup valuation has been a defining force reshaping the investment landscape globally and in major Indian...

3 min read

Impact of Dilution on Founder's Equity

Launching a startup is a dream for many, but understanding the impact of founders equity dilution is critical for long-term success....

4 min read

bottom of page