top of page

When to Get a 409A Valuation: Timing & Frequency

Determining when to get a 409A valuation is a vital step for startups and private companies issuing stock options. A 409A valuation...

3 min read

409A Valuation for Startups: Compliance Essentials

Startups thrive on innovation and growth, often rewarding employees and founders through equity compensation. However, to ensure legal...

4 min read

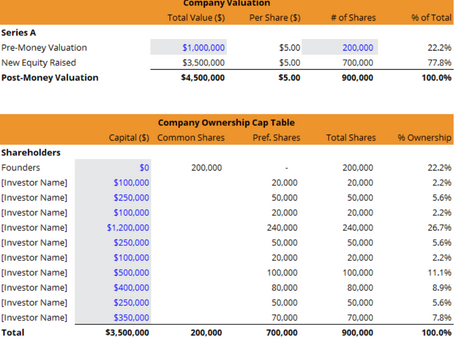

Using Cap Tables to Track Valuation Changes

In the fast-paced world of startups and investments, cap table valuation tracking is no longer just an administrative task it’s a...

4 min read

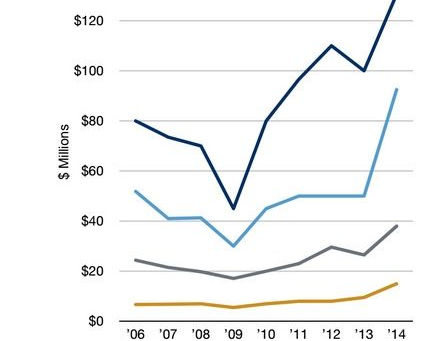

Risk Factor Summation Method Explained

When it comes to valuing startups, one method that has gained widespread acceptance among investors and analysts is the risk factor...

4 min read

Venture Capital Method: Valuation for Series A & Beyond

Understanding the venture capital method valuation is crucial for founders and investors navigating the startup fundraising journey,...

3 min read

How to Calculate Pre-Money Valuation for Early-Stage Startups.

Understanding how to calculate pre money valuation is a critical step for early-stage startups looking to attract seed funding and...

3 min read

bottom of page