top of page

How 409A Affects Employee Stock Options

Employee stock options (ESOPs) are a popular way for startups and growing companies to attract and retain talent by sharing equity with...

3 min read

409A Valuation for Startups: Compliance Essentials

Startups thrive on innovation and growth, often rewarding employees and founders through equity compensation. However, to ensure legal...

4 min read

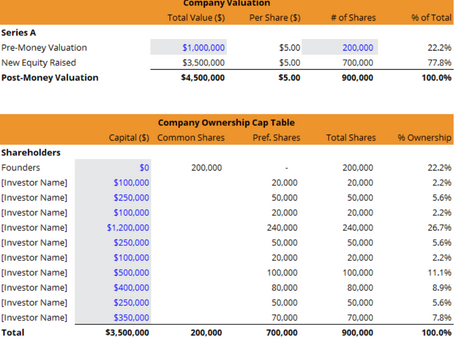

Using Cap Tables to Track Valuation Changes

In the fast-paced world of startups and investments, cap table valuation tracking is no longer just an administrative task it’s a...

4 min read

How Investor Due Diligence Affects Your Valuation

When preparing for fundraising, one of the most critical factors that shape your startup’s worth is investor due diligence valuation....

4 min read

Decoding SEC Regulations: A Startup's Guide to Compliant Fundraising

Balancing the scales of SEC regulations and startup growth is key to compliant fundraising Introduction For startups seeking to raise...

4 min read

Navigating the Complexities of Startup Funding Compliance

Navigating the path to successful startup funding requires a strong foundation in compliance. Introduction Securing funding is a critical...

3 min read

Don't Risk Your Brand: The Ultimate Guide to Trademark Registration for Startups

"Protect your brand, secure your future. Trademark registration is the shield your startup needs." Introduction: Your Brand Is More Than...

4 min read

bottom of page