top of page

When to Get a 409A Valuation: Timing & Frequency

Determining when to get a 409A valuation is a vital step for startups and private companies issuing stock options. A 409A valuation...

3 min read

409A Valuation for Startups: Compliance Essentials

Startups thrive on innovation and growth, often rewarding employees and founders through equity compensation. However, to ensure legal...

4 min read

Exit Valuation: Preparing for M&A or IPO

When a startup or growing company approaches an exit, understanding exit valuation is crucial. Exit valuation refers to the value of a...

3 min read

Role of Board-Approved Valuations in Fundraising

Raising capital is a critical phase for any startup, and one element that significantly boosts investor confidence is a board approved...

3 min read

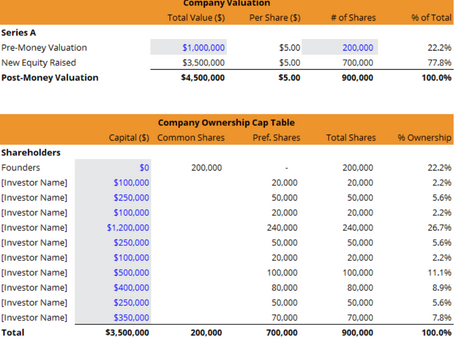

Using Cap Tables to Track Valuation Changes

In the fast-paced world of startups and investments, cap table valuation tracking is no longer just an administrative task it’s a...

4 min read

How to Value a Bootstrapped Startup

Valuing a bootstrapped startup is both an art and a science. Unlike their venture-funded counterparts, these startups are built on...

3 min read

Crowdfunding Valuation: What Backers Want to Know

Crowdfunding valuation has become a central aspect of fundraising campaigns for startups and entrepreneurs, especially across booming...

4 min read

Secondary Market Valuations: Liquidity Events

Understanding secondary market valuation is crucial for startups, investors, and employees navigating the complex world of private share...

2 min read

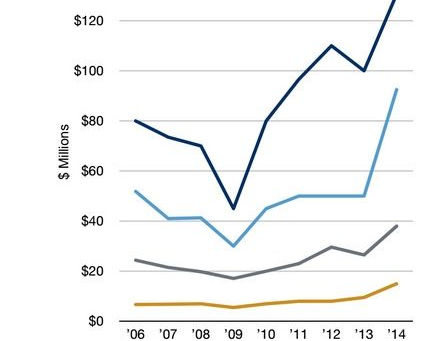

How Pandemic Shifts Changed Startup Valuations

The pandemic impact on startup valuation has been a defining force reshaping the investment landscape globally and in major Indian...

3 min read

Impact of Dilution on Founder's Equity

Launching a startup is a dream for many, but understanding the impact of founders equity dilution is critical for long-term success....

4 min read

Valuing Startups in Fintech

In today’s dynamic investment environment, sector specific startup valuation is becoming essential, especially within transformative industries like Edtech & Clean Energy. While fintech startups have long been a focus for investors, emerging sectors such as edtech and clean energy are rapidly gaining attention for their growth potential and innovation, with valuation methods tailored to their unique characteristics. Understanding how to value startups across these sectors pro

4 min read

How Investor Due Diligence Affects Your Valuation

When preparing for fundraising, one of the most critical factors that shape your startup’s worth is investor due diligence valuation....

4 min read

How to Negotiate Valuation in a Term Sheet

Negotiating startup valuation is one of the most critical aspects of securing funding during the early stages of your business journey....

3 min read

SAFE and Convertible Note Valuations

Early-stage startups often face the challenge of raising capital efficiently while minimizing legal complexities and maintaining focus on...

3 min read

Using Comparables in Startup Valuation

When it comes to comparables startup valuation, startup founders and investors alike seek reliable methods to estimate a company’s worth...

3 min read

Revenue-Based Valuation: When It Works Best

In the dynamic world of startups, especially in fast-growing sectors like SaaS and e-commerce, finding the right valuation method is...

3 min read

Risk Factor Summation Method Explained

When it comes to valuing startups, one method that has gained widespread acceptance among investors and analysts is the risk factor...

4 min read

Scorecard Method: Benchmarking Against Peers

The scorecard method valuation is a powerful tool widely used in the startup ecosystem to value early-stage companies by benchmarking...

4 min read

Venture Capital Method: Valuation for Series A & Beyond

Understanding the venture capital method valuation is crucial for founders and investors navigating the startup fundraising journey,...

3 min read

How to Calculate Pre-Money Valuation for Early-Stage Startups.

Understanding how to calculate pre money valuation is a critical step for early-stage startups looking to attract seed funding and...

3 min read

bottom of page