top of page

Exit Valuation: Preparing for M&A or IPO

When a startup or growing company approaches an exit, understanding exit valuation is crucial. Exit valuation refers to the value of a...

3 min read

Role of Board-Approved Valuations in Fundraising

Raising capital is a critical phase for any startup, and one element that significantly boosts investor confidence is a board approved...

3 min read

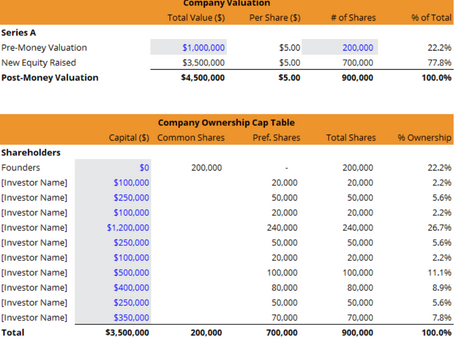

Using Cap Tables to Track Valuation Changes

In the fast-paced world of startups and investments, cap table valuation tracking is no longer just an administrative task it’s a...

4 min read

How to Value a Bootstrapped Startup

Valuing a bootstrapped startup is both an art and a science. Unlike their venture-funded counterparts, these startups are built on...

3 min read

Crowdfunding Valuation: What Backers Want to Know

Crowdfunding valuation has become a central aspect of fundraising campaigns for startups and entrepreneurs, especially across booming...

4 min read

Secondary Market Valuations: Liquidity Events

Understanding secondary market valuation is crucial for startups, investors, and employees navigating the complex world of private share...

2 min read

How Pandemic Shifts Changed Startup Valuations

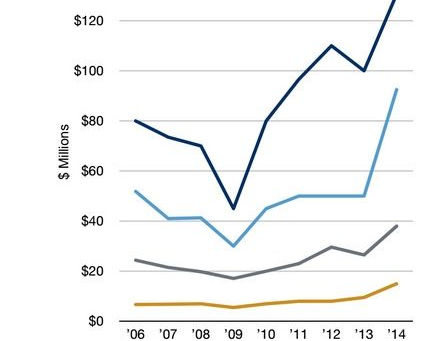

The pandemic impact on startup valuation has been a defining force reshaping the investment landscape globally and in major Indian...

3 min read

Impact of Dilution on Founder's Equity

Launching a startup is a dream for many, but understanding the impact of founders equity dilution is critical for long-term success....

4 min read

Valuing Startups in Fintech

In today’s dynamic investment environment, sector specific startup valuation is becoming essential, especially within transformative industries like Edtech & Clean Energy. While fintech startups have long been a focus for investors, emerging sectors such as edtech and clean energy are rapidly gaining attention for their growth potential and innovation, with valuation methods tailored to their unique characteristics. Understanding how to value startups across these sectors pro

4 min read

How Investor Due Diligence Affects Your Valuation

When preparing for fundraising, one of the most critical factors that shape your startup’s worth is investor due diligence valuation....

4 min read

How to Negotiate Valuation in a Term Sheet

Negotiating startup valuation is one of the most critical aspects of securing funding during the early stages of your business journey....

3 min read

How to Calculate Pre-Money Valuation for Early-Stage Startups.

Understanding how to calculate pre money valuation is a critical step for early-stage startups looking to attract seed funding and...

3 min read

How to Prepare Your Financials for a Valuation

Valuation is one of the most critical steps for any business, whether you' re raising capital, selling your company, or planning for an...

3 min read

Company Valuation vs. Startup Valuation: Diverging Approaches

In today’s ever-changing business landscape, company valuation vs startup valuation has become a hot topic for entrepreneurs, investors,...

4 min read

Common Valuation Mistakes and How to Avoid Them

Valuations are critical in making informed decisions about investments, mergers, acquisitions, and financial reporting. However, common...

3 min read

Revenue Multiple Valuation: Pros and Cons

Introduction In today's rapidly evolving business landscape, revenue multiple valuation has emerged as a popular approach for analyzing...

3 min read

Business Valuation Formula

The Core Fundamentals Understanding how to value a business is crucial for entrepreneurs, investors, and finance professionals alike. If...

3 min read

Enterprise Value Formula: Calculation & Interpretation

Enterprise value is a cornerstone metric in corporate finance, especially for anyone dealing with mergers, acquisitions, or fundamental...

3 min read

Discounted Cash Flow (DCF) Model Demystified

If you're looking to master the art of valuing businesses, the discounted cash flow model stands as one of the most powerful tools in...

3 min read

bottom of page